Falconry360 digitizes the full Internal Controls over Financial Reporting (ICFR) lifecycle—from design and documentation to testing, remediation, and regulator-ready reporting—on a single platform. Aligned with COSO 2013, IFRS-based reporting, and GCC regulations, including UAE ADAA ICFR / SCA, KSA CMA, and Qatar QFMA requirements.

Maintain effective, documented controls over key financial processes

Perform structured, evidence-backed testing and remediation

Provide clear, traceable reporting to Boards, regulators, and auditors

ADAA ICFR Framework & SCA Governance Code

Annual internal control evaluation, Board oversight, and entity-level governance dashboards.

CMA Corporate Governance Regulations (SOCPA-aligned)

CFO attestation, control testing expectations, and structured documentation requirements.

QFMA Governance Code / ICFR Expectations

Strong emphasis on design effectiveness, evidence-backed reporting, and annual disclosure.

COSO 2013, IFRS

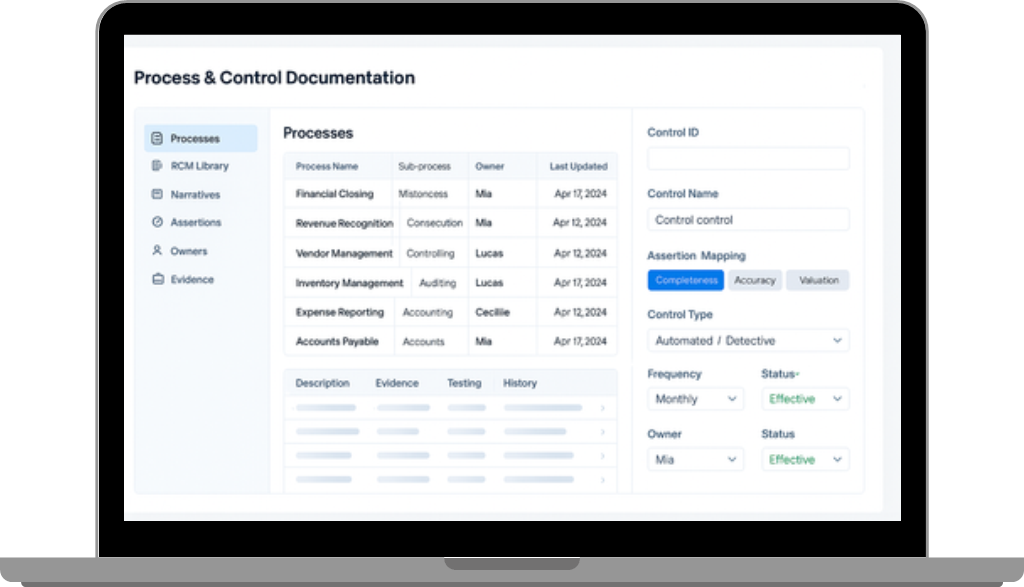

Standardized control library and reporting model so groups can run consistent ICFR programs across regions.

Unified RCM library mapped to COSO 2013 and IFRS cycles.

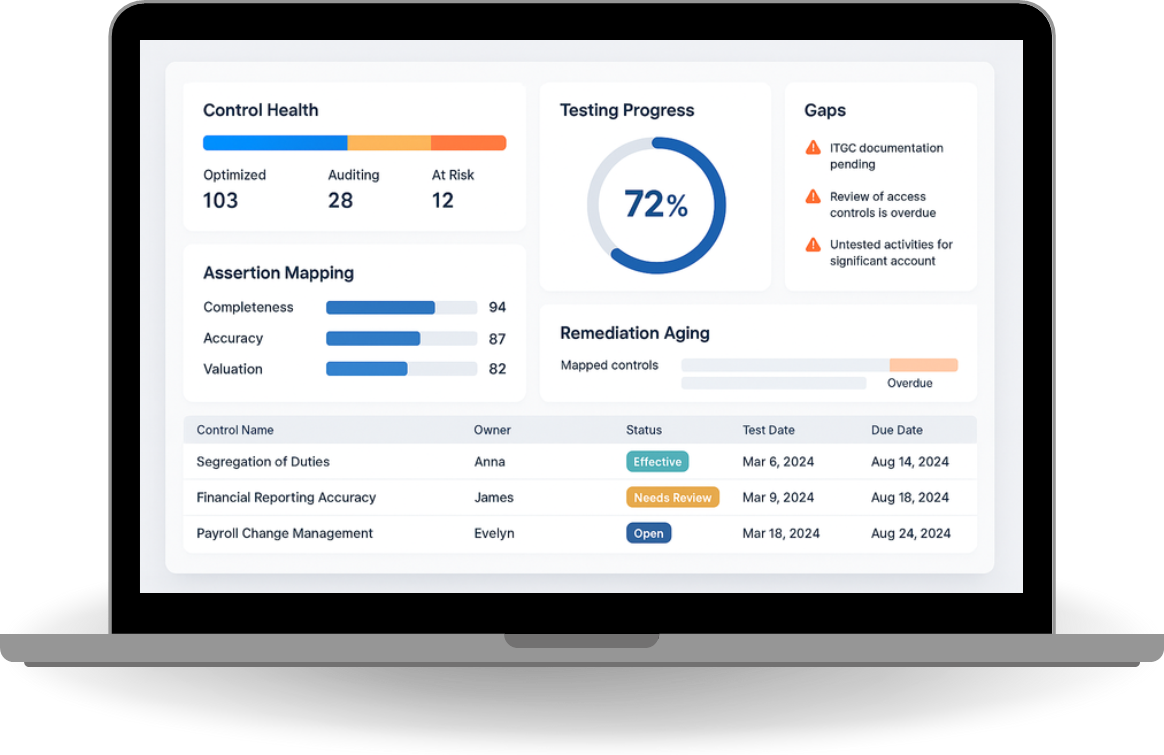

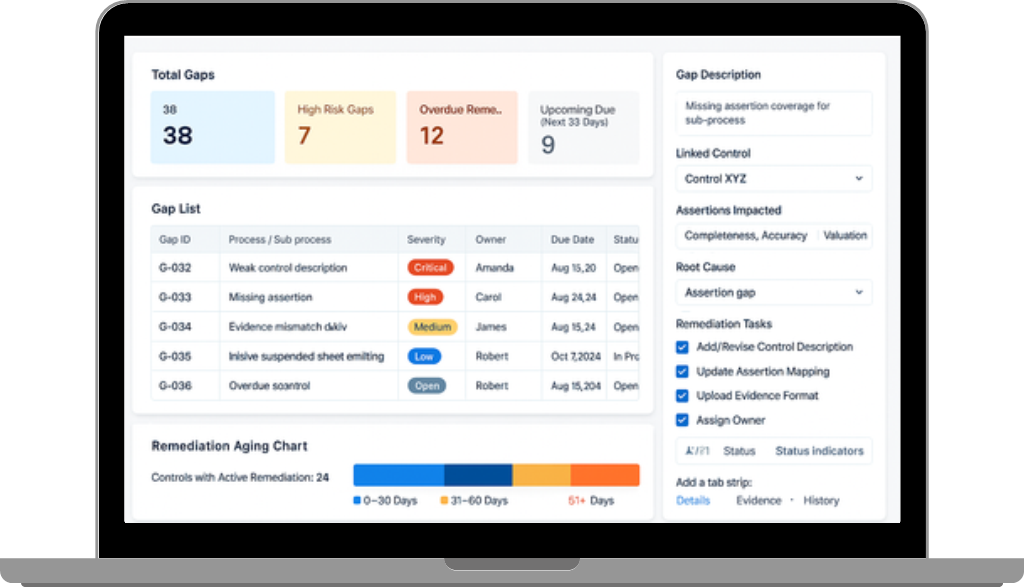

Automated identification of weak controls, missing assertions, and mapping inconsistencies.

Structured workflows with ownership, checklists, and tracking.

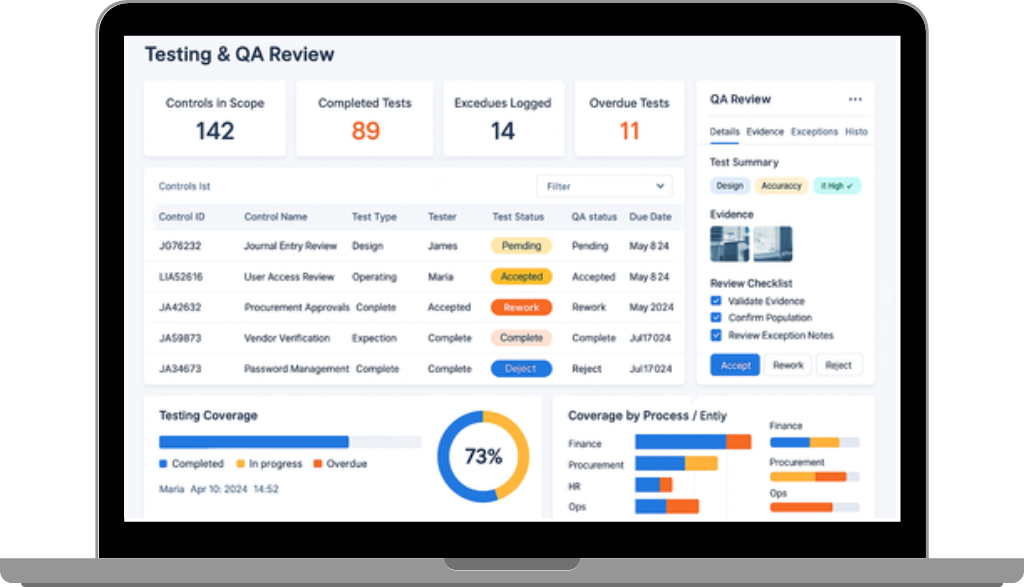

Automated sampling, testing templates, exception capture, and evidence linkage.

Independent reviewer layer with acceptance, rework, and escalation workflows.

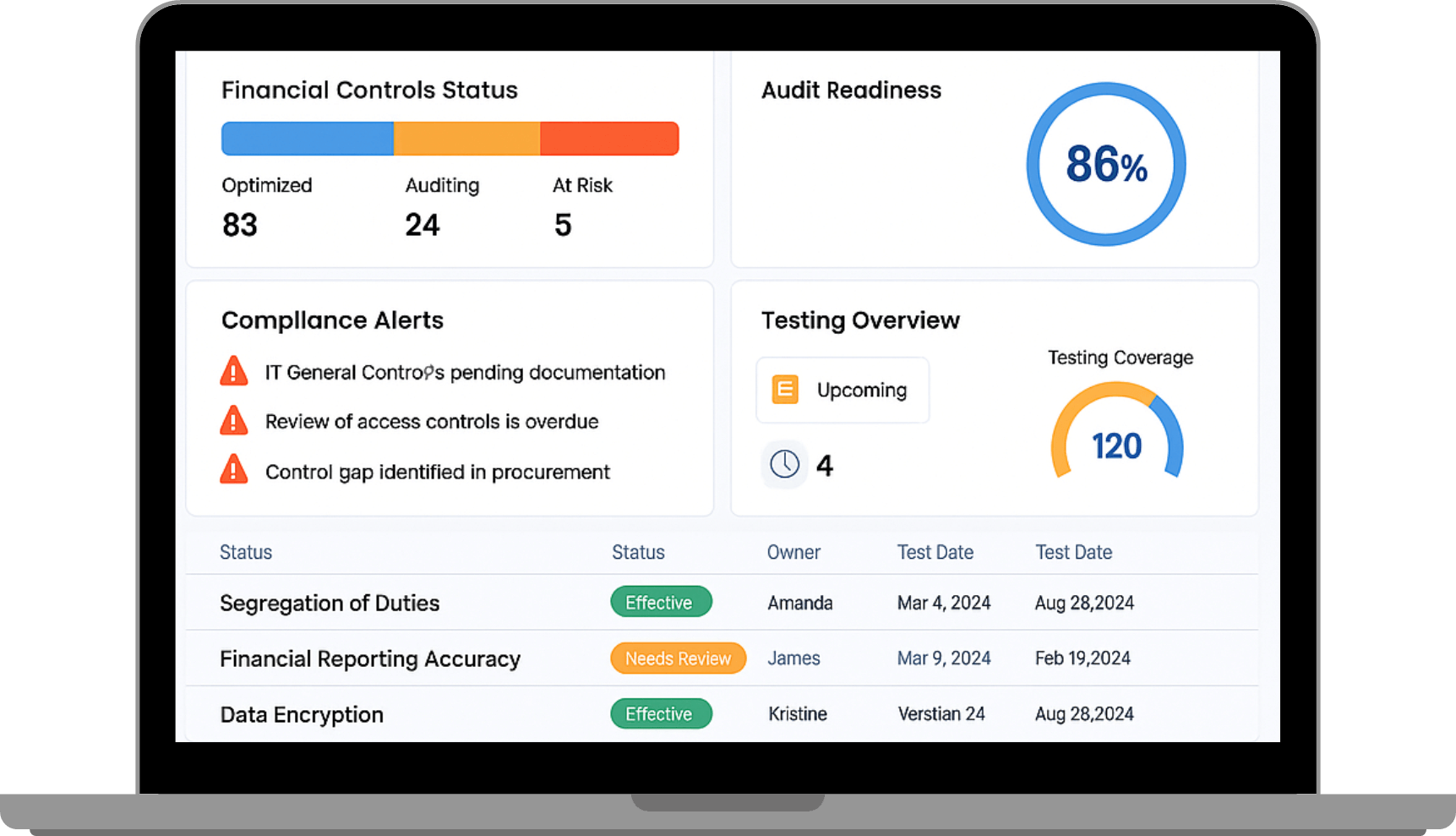

Executive dashboards, SOX-style reporting, and auditor-ready documentation packs.

© 2025 Falconry360 . All rights reserved.